The Essential SBUs for MSMEs: A Six Thinking Hats Perspective for C-Suite Mastery

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, driving innovation, employment, and regional development. However, the operational complexity often becomes a bottleneck for sustainable growth. For a C-Suite leader navigating the MSME space, understanding and harmonising the essential Strategic Business Units (SBUs) is paramount to long-term success.

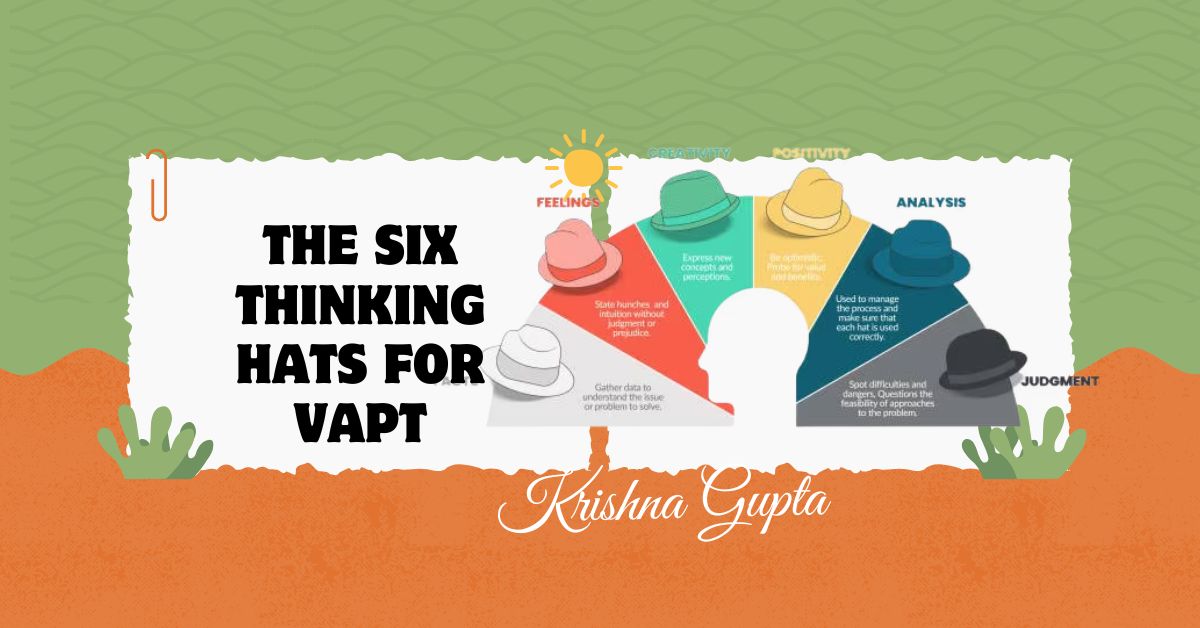

This blog post explores the 11 Essential SBUs required for a robust MSME structure, through the lens of Edward de Bono’s Six Thinking Hats methodology—an innovative framework that enhances decision-making by separating different modes of thinking. Each SBU is evaluated with all six hats to provide a well-rounded, executive-level perspective for business optimisation, risk mitigation, and improved ROI.