Return on Equity (RoE): A Comprehensive Guide for Angel Investors, Entrepreneurs, and Venture Capitalists

Introduction: Understanding the Power of Return on Equity (RoE)

Return on Equity (RoE) is one of the most essential financial metrics for evaluating a company’s profitability in relation to its shareholders’ equity. It’s a critical indicator for decision-making, especially for angel investors, entrepreneurs, and venture capitalists who are keen on maximising returns while mitigating risk. RoE offers an insightful glance into how efficiently a company is using its capital to generate profits, ultimately determining its long-term viability and attractiveness for investment.

This blog will comprehensively explore RoE, from its calculation and interpretation to its implications on business performance and investment strategies. By providing detailed examples, practical insights, and a focus on business impact, we aim to equip C-Suite professionals with a profound understanding of RoE and its relevance to the entrepreneurial ecosystem.

1. What is Return on Equity (RoE)?

RoE is a measure of financial performance calculated by dividing net income by shareholders’ equity. It represents the return earned on the money that shareholders have invested in the company. Essentially, RoE answers the question: “How well is the company using investors’ funds to generate profits?”

RoE Formula:

Example: If a company has a net income of €500,000 and shareholders’ equity of €2,000,000, the RoE would be:

A RoE of 25% indicates that the company generates a €0.25 profit for every €1 of shareholders’ equity.

2. The Importance of RoE for Angel Investors, Entrepreneurs, and Venture Capitalists

RoE is more than just a ratio—it’s a reflection of a company’s efficiency in turning equity capital into profits. Understanding RoE can help C-Suite executives and investors evaluate a company’s profitability, scalability, and overall health.

2.1 Evaluating Profitability and Efficiency

For investors, RoE provides insight into how effectively a company is using its equity to generate profits. A higher RoE typically suggests that a company is effectively managing its resources, which can be particularly attractive to angel investors and venture capitalists looking for high-growth opportunities.

2.2 Comparing Industry Standards

RoE is also crucial for comparing companies within the same industry. Different industries have varying levels of capital intensity, which affects their RoE benchmarks. For instance, a tech start-up may have a higher RoE than a utility company due to its lower capital requirements and higher scalability potential.

Practical Insight: When evaluating RoE, it’s important to compare it with industry peers rather than using an absolute benchmark. A tech start-up with a RoE of 20% might be more favourable compared to an industry average of 15%, indicating superior performance.

2.3 Assessing Management Efficiency

A strong RoE often indicates competent management that is able to allocate capital efficiently. For entrepreneurs, maintaining a high RoE can signal to investors that their business is being run well, which can help in attracting further investment. On the other hand, a declining RoE could be a red flag, suggesting inefficiencies or rising costs.

3. The Components of RoE: DuPont Analysis

To understand RoE in greater detail, investors often use the DuPont Analysis, which breaks RoE down into three distinct components:

- Net Profit Margin: Measures how much profit the company makes for every pound of sales.

- Asset Turnover: Indicates how efficiently the company is using its assets to generate sales.

- Equity Multiplier: Reflects the degree of financial leverage the company is using.

3.1 Breaking Down the DuPont Formula

Net Profit Margin: A higher profit margin indicates better cost control and pricing strategy, which directly boosts RoE.

Example: If a company has €1,000,000 in sales and €100,000 in net income, the net profit margin is:

Asset Turnover: This ratio shows how well a company is using its assets to generate revenue. A higher turnover means assets are being used effectively.

Example: If a company has €2,000,000 in assets and €1,000,000 in sales, the asset turnover is:

Asset Turnover=2,000,0001,000,000=0.5

Equity Multiplier: The equity multiplier indicates the level of financial leverage (i.e., debt) being used by the company.

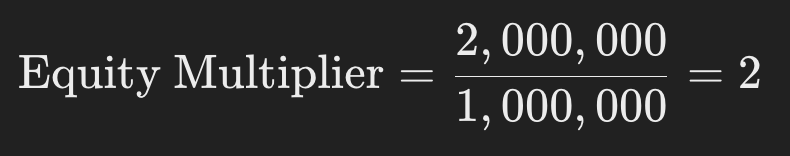

Example: If a company has €2,000,000 in assets and €1,000,000 in equity, the equity multiplier is:

Equity Multiplier=1,000,0002,000,000=2

Combining these three components gives a clearer picture of what drives a company’s RoE and helps identify areas for improvement.

4. RoE: A Double-Edged Sword

While RoE is an important metric, it is crucial to understand that a high RoE is not always positive. There are potential pitfalls that investors and entrepreneurs must consider.

4.1 The Impact of High Financial Leverage

A company can artificially boost its RoE by taking on more debt. This increased leverage raises the equity multiplier, leading to a higher RoE. However, this also increases the company’s financial risk.

Example: If a company’s RoE jumps from 15% to 30% due to increased debt, the investor must evaluate whether the company can sustain this level of debt, especially in times of economic downturn.

4.2 Sustainability of RoE

For entrepreneurs, maintaining a consistent RoE is vital. A sharp increase followed by a decline may indicate an unsustainable business model or temporary gains that cannot be replicated. Investors often look for stable or steadily increasing RoE over time.

5. RoE in Different Growth Stages of a Business

The interpretation of RoE varies depending on the business’s growth stage. Whether it is an early-stage start-up or a mature enterprise, RoE provides different insights.

5.1 Early-Stage Start-Ups

In the early stages, many companies may have a low or even negative RoE due to high initial expenses and lower revenue. Angel investors and venture capitalists must focus on the potential for RoE growth rather than the current ratio.

Storytelling Example: Consider a tech start-up with negative RoE due to significant R&D investments. While the initial numbers may be discouraging, the potential for exponential RoE growth once the product is launched can be immense.

5.2 Growth-Stage Companies

For companies in the growth stage, RoE should begin to increase as revenues grow and expenses stabilise. A consistently increasing RoE signals effective scaling and management efficiency, making such companies attractive to investors.

5.3 Mature Companies

For mature companies, RoE serves as an indicator of stability. Entrepreneurs running established businesses must focus on maintaining RoE through strategic initiatives, efficient capital allocation, and cost management.

6. Improving Return on Equity: Strategies for Entrepreneurs

Entrepreneurs have several strategies at their disposal to improve RoE, which can make their business more attractive to potential investors.

6.1 Enhancing Profit Margins

Cost Control: Reducing operational costs without sacrificing quality can lead to a higher net profit margin and thus boost RoE.

Pricing Strategy: Optimising pricing can help in improving profit margins, particularly if the company offers unique products or services with a competitive edge.

6.2 Optimising Asset Utilisation

Inventory Management: Effective inventory management can reduce excess stock and improve asset turnover, which positively affects RoE.

Technological Upgrades: Investing in technology to automate processes can enhance efficiency and reduce the asset base required to generate revenue.

6.3 Leveraging Financial Structure

Debt Management: While leveraging can boost RoE, maintaining an optimal debt level is crucial. Entrepreneurs should focus on using debt to fund growth opportunities that generate returns higher than the cost of debt.

Share Buybacks: Reducing the equity base by buying back shares can increase RoE, provided the company has excess cash and limited growth opportunities.

7. RoE vs Other Financial Metrics: A Holistic View

While RoE is a valuable measure, relying solely on it can lead to an incomplete understanding of a company’s financial health. It’s important to consider RoE alongside other metrics for a holistic view.

7.1 Return on Assets (RoA)

RoA measures how efficiently a company is using its assets to generate profits. While RoE focuses on equity, RoA considers the entire asset base, providing insight into overall efficiency.

7.2 Return on Investment (RoI)

RoI looks at the profitability of specific investments. For venture capitalists, RoI is useful in evaluating individual projects or acquisitions, whereas RoE provides a broader view of overall company performance.

Comparing RoE with the Debt-to-Equity Ratio provides insight into whether the company’s profitability is being achieved through financial leverage. A high RoE combined with a high debt-to-equity ratio suggests that the company is relying significantly on debt to enhance returns, which may increase financial risk. Conversely, a high RoE with a moderate debt-to-equity ratio indicates effective management and a balanced capital structure, reducing risk for investors.

8. Real-World Examples: How RoE Shapes Investment Decisions

8.1 Case Study: High RoE with Low Debt – Apple Inc.

Apple Inc. is known for consistently delivering high RoE while maintaining relatively low debt levels compared to its equity. This balance makes it a prime example of how a company can efficiently use shareholders’ funds to generate returns without relying heavily on leverage. This kind of RoE stability and prudent capital management makes Apple attractive to both individual and institutional investors.

8.2 Case Study: High RoE with High Debt – Tesla Inc.

Tesla has often shown a high RoE, partially driven by its extensive use of debt to fund its rapid growth. For venture capitalists and investors looking for high returns, Tesla’s high RoE has been appealing, but the associated risks have also been high due to its elevated debt levels. This case illustrates the importance of analysing RoE alongside leverage to understand the risk profile of the investment.

9. Limitations of RoE and Common Misinterpretations

While RoE is a powerful metric, it has certain limitations that investors should be aware of:

9.1 Effect of Share Buybacks

Companies can artificially increase RoE by buying back shares, which reduces shareholders’ equity and subsequently raises the RoE ratio. While this can signal that the company believes its stock is undervalued, it could also mask underlying profitability issues.

Example: If a company’s RoE increases primarily due to share buybacks, it does not necessarily mean that its operational efficiency has improved.

9.2 Accounting Manipulations

RoE can be influenced by accounting choices, such as how a company values its assets or handles depreciation. Investors must be vigilant and look beyond the RoE figure to understand the financial decisions driving it.

9.3 Ignoring the Cost of Equity

RoE does not consider the cost of equity, which can lead to a misleading impression of value creation. A company may have a high RoE, but if it is not generating returns above the cost of equity, it may not be adding true value for shareholders.

10. Practical Tips for Using RoE in Investment Decisions

10.1 Context Matters: Look Beyond the Number

When evaluating RoE, it is essential to consider the context, including the industry, the company’s growth stage, and the overall economic environment. A high RoE in a capital-intensive industry like utilities may not hold the same weight as a similar RoE in a tech start-up.

10.2 Look for Consistency

Investors should look for companies with a stable or gradually increasing RoE over time, as this indicates consistent management performance. A company with fluctuating RoE might be experiencing operational inefficiencies or market volatility.

10.3 Compare RoE with Other Metrics

Use RoE alongside other financial metrics, such as Return on Assets (RoA), Return on Capital Employed (RoCE), and the Debt-to-Equity Ratio, to gain a comprehensive understanding of a company’s financial health.

11. The Role of RoE in Strategic Investment Decisions

Return on Equity (RoE) remains a cornerstone metric for angel investors, entrepreneurs, and venture capitalists. It serves as a critical indicator of how well a company utilises shareholders’ equity to generate profit, providing insights into profitability, management efficiency, and the potential for growth. However, to make informed investment decisions, RoE should not be evaluated in isolation. A comprehensive approach that includes industry context, company growth stage, financial leverage, and complementary metrics ensures a more nuanced understanding of a company’s financial health.

For C-Suite executives, maintaining an attractive RoE involves strategic capital allocation, effective cost control, and prudent use of leverage. A deep understanding of RoE not only helps in improving company performance but also enhances the company’s appeal to potential investors by showcasing a balanced approach to profitability and risk management.

In the dynamic world of investment, RoE is a valuable tool that, when used wisely, can lead to well-informed decisions, ultimately maximising returns while mitigating risks. Whether you’re an angel investor looking for promising start-ups, an entrepreneur seeking to boost your company’s appeal, or a venture capitalist evaluating scalability potential, understanding RoE can be the key to unlocking sustainable growth and success.

RoE vs RoA: Understanding the Differences and Their Implications

Return on Equity (RoE) and Return on Assets (RoA) are two important financial metrics that measure a company’s ability to generate profits. While both provide insights into profitability, they offer different perspectives on a company’s financial performance. Let’s explore their definitions, differences, and how they can be used to complement each other in making informed investment decisions.

12. What is Return on Equity (RoE)?

Return on Equity (RoE) measures the profitability of a company in relation to its shareholders’ equity. It indicates how effectively a company is using the capital provided by its shareholders to generate net income.

Formula:

A higher RoE generally suggests that the company is efficiently using the shareholders’ funds to generate profits, making it attractive to investors. However, RoE can be affected by financial leverage, meaning that increased use of debt can boost RoE but also raises the risk profile of the company.

13. What is Return on Assets (RoA)?

Return on Assets (RoA) measures how efficiently a company is using all of its assets, both equity and debt, to generate profits. It provides a broader view of overall efficiency compared to RoE.

Formula:

A higher RoA indicates that a company is effectively utilising its assets to produce income, which is especially useful in asset-heavy industries where efficient asset management is crucial.

14. Key Differences Between RoE and RoA

14.1 Scope of Measurement

- RoE: Focuses on the profitability relative to shareholders’ equity only. It provides insight into how well the company is rewarding its investors.

- RoA: Considers the profitability relative to total assets, including both debt and equity. It measures the efficiency of asset utilisation regardless of the source of financing.

14.2 Impact of Leverage

- RoE and Leverage: RoE can be significantly impacted by a company’s leverage. A company that takes on more debt might increase its equity multiplier, leading to a higher RoE. This can be beneficial, but it also increases financial risk, especially during times of market instability.

- RoA and Leverage: RoA is less influenced by leverage, as it considers total assets. A company with a high RoA is generally efficient at converting assets into profits, irrespective of whether those assets are financed by debt or equity.

14.3 Use Case and Relevance

- RoE: Most relevant for equity investors who are interested in understanding how well their invested capital is being used to generate returns. It is a good measure of shareholder profitability.

- RoA: Provides a clearer picture of a company’s overall efficiency and is especially useful for understanding how effectively all of a company’s resources (including borrowed capital) are being utilised.

14.4 Interpretation in Different Industries

- Capital-Intensive Industries: In industries such as utilities, real estate, or manufacturing, where companies typically have high levels of assets, RoA is an important metric. It indicates whether the company is generating enough returns to justify the large asset base.

- Service or Technology Industries: In industries where capital requirements are lower, RoE may be more indicative of performance, as it highlights profitability based on shareholders’ investments.

15. An Example: Comparing RoE and RoA

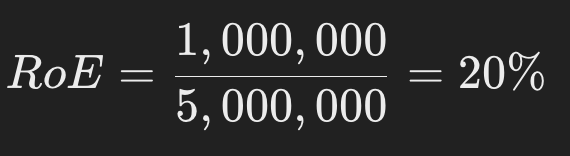

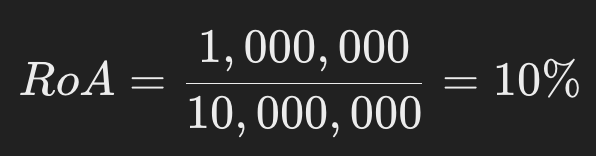

Example Company A:

- Net Income: €1,000,000

- Shareholders’ Equity: €5,000,000

- Total Assets: €10,000,000

Calculating RoE:

Calculating RoA:

Interpretation:

- A RoE of 20% indicates that Company A generates €0.20 for every pound of shareholders’ equity, which suggests efficient use of investor funds.

- A RoA of 10% means that the company generates €0.10 for every pound of assets, indicating its overall efficiency in using all of its resources.

In this case, Company A has a relatively high RoE, but the RoA is lower, suggesting that part of the return on equity is likely influenced by leverage. Investors should assess whether the level of debt is sustainable and if the company can maintain this level of profitability without undue risk.

16. When to Use RoE vs RoA in Decision-Making

16.1 For Angel Investors and Venture Capitalists

- RoE is a key metric for understanding how efficiently a company uses investor funds to generate profit. A consistently high RoE can indicate competent management and effective use of shareholders’ capital, which is particularly attractive when investing in companies at a later growth stage.

- RoA is useful in the early stages when investors want to understand how well the company uses its overall resources to create value. In industries where assets play a crucial role, such as manufacturing or logistics, RoA provides insight into whether the company is likely to become profitable as it scales.

16.2 For Entrepreneurs

- Entrepreneurs should use RoE to demonstrate to investors that their company can efficiently manage shareholders’ funds to generate profit, which can help in raising additional capital.

- RoA can be used internally to assess whether the company’s assets are being utilised effectively. This helps in making strategic decisions about investing in new assets, improving operational efficiency, or divesting underperforming assets.

16.3 Balancing RoE and RoA

- A High RoE with Low RoA: This suggests that a company may be using significant leverage to boost its returns. While this can enhance profitability in the short term, it also raises financial risk, especially in economic downturns.

- A High RoA and Moderate RoE: This scenario indicates that the company is efficiently using its assets, but there may be room to optimise its capital structure to achieve better returns for equity investors.

17. A Complementary Approach

Return on Equity (RoE) and Return on Assets (RoA) each provide unique insights into a company’s financial performance. For angel investors, entrepreneurs, and venture capitalists, understanding both metrics is crucial for making informed decisions:

- RoE focuses on how well a company uses shareholders’ equity to generate profits, making it an essential tool for evaluating returns on invested capital.

- RoA offers a broader view of how efficiently a company utilises its entire asset base to generate income, which is vital in understanding operational efficiency and overall business viability.

By considering both RoE and RoA, investors and entrepreneurs can gain a more comprehensive understanding of a company’s performance, allowing for better assessment of risk, efficiency, and long-term profitability. A high RoE supported by a reasonable RoA often signals that a company is not only profitable but also using its resources prudently—an ideal scenario for any investor.